Understanding the crisis as an opportunity – how the car trade can actively shape structural change

Can the automotive industry be reinterpreted?

Individual mobility means freedom, which everyone is entitled to and which must be made accessible. The claim of politics as well as the mobility industry - car, air and rail transport as well as all other mobility providers alike - must be to protect this freedom for those who already have it, to open it up for those who want or need it, and to secure it for future generations.

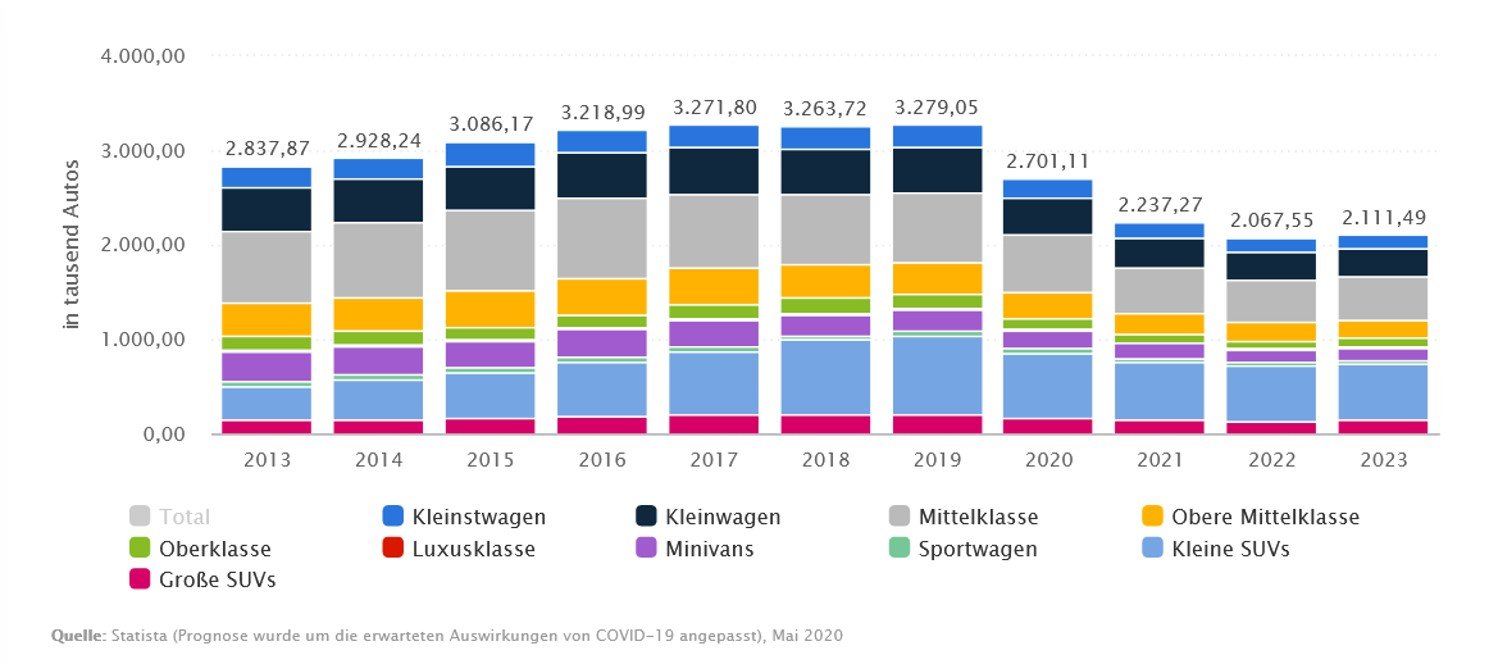

The automotive trade in Germany has been in crisis for a long time: First, a great deal of trust was lost among the public and customers as a result of the diesel scandal. Germany’s former showcase industry had lost its sympathy bonus practically overnight. Then, ongoing discussions about CO2 limits, possible driving bans in inner cities and a widely announced (but so far failed to materialize) mobility shift towards electromobility have led to uncertainty among consumers. Postponed vehicle purchases and the resulting decline in sales figures have caused the already narrow margins in the trade to crumble further - not least fuelled by increasing competition from online brokers and independent leasing companies. The business is in a dangerous downward spiral: in order to achieve bonuses or target premiums, ever larger numbers have to be marketed. In the process, inventories are being run up further and further, and liquidity is being utilized to the maximum. This increases the companies’ susceptibility to crises. As soon as the market weakens even slightly, inventories have to be reduced and vehicles sold - no matter what the cost. On the stock market, this phenomenon is called a ”margin call” – the point at which everyone has to sell in order to maintain their minimum margin, and from then on prices know only one way to go – down.

The young buyer groups are just breaking away because the sense for this type of mobility is no longer understood. In the cities in particular, more and more people are doing without their own cars and using an individual mix of car sharing, ride-hailing buses and trains, rental bikes or e-scooters. Here, the own car becomes a burden: the purchase of a new car is hardly worthwhile for private individuals anymore, because the economic decay is enormous. In addition, the cost of ownership is also a burden. The cost-benefit ratio is becoming increasingly unbalanced. Moreover, anyone who has recently looked for a parking space in the inner cities also understands the annoyance that driving a car in the city regularly causes.

Driving less does not mean that people are less mobile. On the contrary: the number of kilometres travelled per person has risen steadily in recent years. This trend will continue in the coming years. Mobility service providers are successful if they are technologically up to date, ecologically sustainable and affordable, in ride sharing, on-demand mobility services or in the purchase of the family car. The winners will be those who best understand how to bundle mobility services into ecologically implemented business processes. The driving force will become secondary. What will count is the demonstrably sustainable implementation of the easiest-to-acquire and most attractively priced offer on the respective market.

For the automotive trade, this means evolving from new and used car sales to mobility sales. In 2025, successful providers will no longer measure themselves solely by the number of vehicles sold, but also by profit per passenger kilometer - a completely new concept for most. The car of the future is a vehicle on demand that drives autonomously to where it is needed.

The car trade must reinvent itself

The challenge is to break down the wall between online and offline business in the automotive trade and to link both sales channels. The physical touchpoint of the car dealership gets to the heart of the brand experience. However, new concepts for omnichannel retailing are becoming more relevant, creativity and variety are in demand: a pop-up store, a shop-in-shop, an outdoor showroom or a mobility shop where different mobility offers are available. Imagination is demanded of the car trade, which is mostly lacking. Imaginative dealers such as Autohaus König from Berlin, which has been offering its Fiat 500 models via the electronics retailer Media Markt since 8 June, are a rarity.

The aforementioned example immediately slays two fundamental problems of the car trade: on the one hand, the difficulty of gaining access to the customer, who is shaped by the digital shopping culture, and on the other hand, designing the buying process as a stimulating customer journey that consistently and optimally links the online channels (currently still primarily used in the information phase) and the offline channels (such as the test drive, sales talk, or the service appointment). Data glasses, virtual showrooms and / or video consultations do not fill car dealerships, but they do generate attention and drive the comfortable customer off the couch. These offers should have been part of the dealers’ standard repertoire long ago. The challenge is to see digitization as a holistic strategy for the entire company and not just as a collection of isolated measures. A future business model should therefore answer the question of which sales channels will even exist tomorrow and via which new digital channels the company can offer its products and services. In practice, however, too few car dealership entrepreneurs still ask themselves these questions. In many cases, the reason lies in a generational issue: the active management team often comes from an old industrial world in which the manufacturer sent off the assembly line what the dealership was supposed to sell. In the new, digital world, however, the customer determines what he buys when / where / from whom.

Various brands are already pushing ahead with network consolidation and trying to reduce the number of their partner dealers. In urban areas, new formats will gradually replace the classic car dealership. As margins continue to shrink, car dealers will join forces in order to benefit from economies of scale on the one hand and to be able to raise the necessary financial resources for investments in the future on the other. These dealer alliances will increasingly try to build up their own brand, establish these online and offline as platforms and make themselves more independent of manufacturers as suppliers of different brands. In this way, car dealers are becoming like supermarkets, a business dominated by a few giants.

In so-called megastores, new car customers can compare products and prices across brands. They thus find the transparency they are accustomed to from the digital world in a physical location. The difference to the Internet: Megastores and brand boutiques always also score with high-quality advice, which will be highly relevant at least in the medium term with a product that is becoming more and more technologically sophisticated (especially in human-machine communication). So much for the theory.

Entrepreneurs must act now

The Corona crisis reveals another problem of low reserves: car dealerships nationwide had to close their showrooms for several weeks. According to a survey by the ZDK, around 70% of businesses had registered for short-time working in the meantime. For sales staff, the figure was as high as 90%. The primary goal was to secure liquidity at any price. Nevertheless, most companies simply lacked the financial basis to be able to absorb longer sales losses with their own funds. In the past year, the average return in the industry was just 1.4% – in an environment with high investment and capital requirements, too little to build up sufficient equity for emergencies. Many companies are therefore unable to build up a stable equity ratio of at least 25% and are consequently overly dependent on lenders. If even one bank calls in its loans, this means the end for many companies.

The large remainder below the TOP 10 trading groups, however, must ask themselves how they are to continue after Corona. The current crisis should be seen as an opportunity to analyze one’s own situation ruthlessly and to set the necessary course for the future. In doing so, all important stakeholders should be involved: this includes owners/shareholders, the management as well as the most important capital providers. Only if all those involved pull together can a sustainable solution be achieved.

The options for action are as varied as the individual company situations, and there is no patent remedy for all of them. Nevertheless, five strategic initiatives can be identified with the help of which car dealership entrepreneurs should start today in order not to miss the boat for tomorrow:

Creating awareness for change: Herbert Diess works according to the motto ”Think from the customer’s point of view! It is my company! Highest standard for me and my employees! Achieving impact! Concentrating on the essentials! Achieving more with less! Rethinking and simplifying! Backbone, courage and perseverance! Be sincere! Think positively!”

The upcoming transformation will lead to profound changes in terms of work forms, organizational structures and business models. The first essential step is to become aware of this and be open to change. This applies above all to the company’s management - in the second step, it must then prepare the entire company and all employees for the change and take them along on the journey. Many traditional managers are not comfortable with this form of change management - it is too different from what they were used to in the past. At this point, a change manager or coach from outside can help to train and support the managers in dealing with the new challenge.

Examine strategic positioning: Margins in the automotive trade will continue to come under pressure. At the same time, high investments in digitalisation, infrastructure and employees are necessary in order not to lose out. Every company should scrutinize its individual strengths and weaknesses and derive its development opportunities and possible business risks from this. When defining a strategy, it is essential not to think too narrowly, but to be as open as possible to new interpretations of one’s own role. For example, one might discover that there is a great demand for motor homes in a market area or that companies are interested in closed car sharing pools and are looking for a service partner with roots in the region. Both topics are not part of the original dealership business, but can be served with the existing expertise.

Guarantee future viability: Change does not happen immediately, but is a long journey. However, in order to achieve the goal tomorrow, all performance-related processes must be put to the test and optimized in the here and now (operational excellence). This also includes an evaluation of the company’s own organization and management structure: Are the right people on board to initiate and shape the change? If not, shareholders and management need to initiate measures to get the right people on board. If necessary, the help of experienced interim managers is needed who are familiar with crisis situations and can convey the necessary urgency for the situation to the team within a short time and ensure the implementation of the necessary measures.

Securing financing power: In addition to cost discipline and efficiency improvements, sufficient capital resources are just as essential as a balanced capital structure. Here, it is important to analyse exactly how the company’s liabilities are structured and whether the maturity and, not least, the conditions of the individual financings fit in with this (maturity matching). This should be organized together with banks and financing partners. To do this, however, it is first necessary to define the company’s own strategic direction in the form of a resilient business plan. The business plan should cover a time horizon of five years and contain various scenarios as well as an integrated planning calculation consisting of balance sheet, profit and loss account and liquidity and cash flow planning.

Actively shaping the future: There are numerous reasons why a concept that is sustainable in the long term does not materialize: despite adjustments, the company’s own market position no longer appears competitive, sufficient financing cannot be secured for the necessary investments in the new business model, or the shareholders no longer want to go along with the path. In all of these cases, it is important to actively consider various alternatives in order to preserve the company’s value in the best possible way: these can be mergers or acquisitions with competitors, extended cooperations or even the initiation of a structured succession process up to and including the sale of the company.

Mastering the upheaval in the car trade requires a willingness to innovate, the courage to act entrepreneurially, but also analytical skills and a certain objectivity towards the facts. It is therefore advisable to work out one’s strategic reorientation together with a neutral consultant who is not involved in the operational structures and enables an undistorted view of the company with its strengths and weaknesses. In this way, it can be ensured that a comprehensive analysis is carried out that both meets the individual demands and requirements of the dealership / car group and takes into account the changing market conditions.