comes-year outlook 2021

Probably no one expected the course of 2020 in this form. Instead of addressing global trends, many companies had to face Covid-19 and not everyone will survive the crisis. With continued high infection rates and enacted measures, it is clear that 2021 will be as much about the Corona Crisis. Issues such as adaptation and, more importantly, resilience will play a major role in the face of existential fears. But what other topics will occupy the economy in the coming year besides the pandemic, and to what extent has structural change been influenced by the crisis?

Economy global

In 2021, the global economy will be shaped, among other things, by the world’s largest free trade agreement, which the economically leading countries of the Asia-Pacific region have signed. The agreement will mark a turning point in the geopolitical world order and the PR China in particular will benefit from it. Already in 2020, China’s economy was still growing at 2%, unlike other nations, despite the Corona pandemic fallout. In November 2020, China’s exports grew 20% year-over-year. The dependence on China will continue to increase in the coming years. It will become all the more important for Germany and Europe, on the one hand, to revive their partnership with the US and, on the other, to further expand their presence in Asian markets. Furthermore, the economic development of the two economies, the USA and China, is being driven by enormous economic stimulus packages, so that the export-strong German economy in particular could benefit from this. In addition, the ECB will continue to maintain its package of measures so that the European economy is supported. Although a Brexit trade agreement has been agreed between the United Kingdom and the EU, the country’s exit from the EU will nevertheless continue to occupy the economy in the new year. However, Brexit will hit the UK harder as the EU is the largest trading market for the UK. Due to the provision of vaccines and further fiscal policy measures, it can be assumed that the economy will probably develop positively in the course of the year, provided that the lockdown is largely ended in the course of the first quarter.

Economy national

With the ongoing lockdown, a return to pre-crisis levels in 2021 is becoming increasingly unlikely. However, it can be assumed that there will be further massive support measures for the economy from politicians, at least until the upcoming federal election. Various packages of measures and a temporary suspension of the obligation to file for insolvency (mainly due to over-indebtedness) have at least postponed the impending wave of insolvencies into the future. Essentially all sectors are affected by the Corona crisis. Examples include the hospitality industry, retail, the hotel sector and the mobility and events sector, which have been hit hardest by the measures. Various companies will continue to have to claim short-time working benefits on a large scale.

In addition, the “Act on the Stabilisation and Restructuring Framework for Companies” (StaRUG) came into force on 1 January. The Act obliges the management of a company to protect the interests of creditors and to implement a system for the early detection of crises in its corporate organisation. In future, companies will have to pay more attention to their liquidity planning. In general, the Act aims to distinguish more clearly between over-indebtedness and imminent insolvency and to enable early corporate restructuring as a measure to avert insolvency.

Another factor that will have an impact on German society is the Bundestag elections in autumn 2021. After 16 years and four legislative periods, Angela Merkel’s term in office will come to an end. The study “Young Germans 2021” makes it clear that young people currently feel let down by politics. With a view to the Bundestag elections, it is evident that politics must win over young voters who grew up with Merkel and address socially relevant issues. The future federal government will determine the political-strategic direction of Germany in the national and global arena.

Trade

After the end of the lockdown, there will be catch-up effects in the trade, at least for some areas. However, a large part of the trade will face a tense economic year due to the long lockdown and the hygiene measures that will certainly continue to exist. A large number of insolvencies are expected. However, the problems, especially in brick-and-mortar retail, are not entirely due to the Corona pandemic. They lie much further in the past. The structural problems have caught up with retailers more quickly than expected and are accelerating the market shakeout in the segment. Sustainable offers, such as second hand as well as circular fashion and/or articles, are becoming stronger in terms of turnover as people are increasingly consuming more consciously.

In addition, the issues of connectivity and technology are changing retail in that personless shopping or in-store digital presentations will become more prevalent. Retailers should also introduce new technologies such as augmented reality. However, this will require technology-savvy employees. There will also be a re-evaluation of the location and even stronger networking between online and stationary business. The question will arise whether an online business with occasionally opened pop-up stores is preferable to a purely stationary business model.

Furthermore, the current crisis is accelerating the transformation of city centres. The dominance of chain stores has already increased in recent years. With the home office, above all the movement profile and buying behaviour in the big cities has changed. People are increasingly staying in their neighbourhoods and using local retailers and gastronomy, which is a great opportunity for smaller owner-managed stores. In addition, hybrid models will become more prevalent. Accordingly, consumers will want to shop in independent stores. Above all, mixed-use cities and mixed-use neighbourhoods will establish themselves in order to make the transition from a car-oriented city to a compact city that is in line with urbanisation. Sustainable neighbourhoods are characterised by a holistic mixed-use form that includes workplaces, shopping and leisure facilities, social meeting places and residential areas.

In the field of e-commerce, direct-to-consumer (D2C) business will become elementary. More and more manufacturers of consumer goods are relying on direct customer contact to sell their products. Intermediaries are losing relevance. This is caused, among other things, by shopping via social media, so-called social commerce, and messenger shopping, so-called conversational commerce. In addition, food retailers and producers of fast-moving consumer goods, so-called FMCG companies, are adapting their business model to online retailing. Subscription models and click & collect, which were well suited during the Corona crisis, will continue to establish themselves. E-commerce also benefits logistics, which primarily has to optimize the so-called last mile of delivery. It is conceivable that suppliers in less densely populated areas will cooperate, split up spatially and/or that delivery by drone will become established in rural regions in the future.

Real Estate

Real estate markets always react to economic changes with a time lag. The recession in the wake of the pandemic will primarily affect rents and property values in the course of 2021. Commercial real estate in the retail sector as well as hotels are suffering the most due to the lockdown measures on the one hand and the changing purchasing behaviour of consumers on the other. Consequently, there have been and will be further rent losses. There is a threat of vacancies in the medium term, especially in less favoured locations. As a result, the price declines that were already occurring before the pandemic will continue in some regions for commercial real estate.

In contrast, take-up of office properties has declined for the time being in the course of 2020. Partly as a result of low vacancy rates and a low level of new construction activity in the past, the increasing reluctance of investors to take up office space has not yet had any impact on the development of rents. In 2021, the demand for office space is likely to be weaker due to the previous development and have a dampening effect on the development of rents. However, free-standing space will remain manageable in view of the low starting level, meaning that pronounced rent declines are unlikely.

Der Markt für Wohnimmobilien zeigt sich bislang sehr robust. Explizit die ländlichen Regionen bzw. die Umlandkreise von Metropolregionen werden langfristig von der Krisenzeit profitieren. Durch die Phase der Lockdowns ist die WertThe market for residential real estate has been very robust to date. Explicitly the rural regions or the surrounding districts of metropolitan regions will benefit from the crisis period in the long term. The phase of lockdowns has further increased the appreciation of one’s own residential property. Many households have realised the importance of sufficient space. Especially for families, the surrounding areas are interesting, because in the cities there is sometimes a surplus of demand, so that there is no slump in the purchase prices for residential real estate. This is helped by the fact that real estate loans are currently at hardly more than 1%. This fact has since caused a stable residential construction market.

Fairs/Events

The trade fair and event industry is one of the sectors most affected by the Corona crisis. Further support for the industry is planned by the federal government. Concert organisers are to be encouraged to plan events. To this end, the federal government wants to make all expenses billable that, contrary to expectations, cannot be realized due to the Corona restrictions. In addition, a subsidy program for the cultural industry is to be enacted in 2021. In general, the trade fair and event industry will be characterised by after-hours events in the coming year. So far, Germany has been the world market leader in the trade fair industry. However, the focus will shift to the Far East after China already organised numerous trade fairs in the pandemic year. In Germany, on the other hand, private trade fair companies are threatened with insolvency. As a future trend, it is becoming apparent that roadshows and online events will be a prospect for companies in order to be able to acquire new customers independently of large trade fairs.

Hospitality industry (gastronomy and hotel industry)

The drop in sales in the events industry and the lockdown are also consequential for the hospitality industry. Food service businesses were among the first to be forced to close in the wake of the pandemic, limiting their ability to generate revenue through delivery services and takeaways. It is likely that the catering industry will be considered for relaxation measures at a late stage. Due to the contact restrictions still in place, as well as hygiene and safety measures, there will certainly be restrictions throughout the year, meaning that significantly fewer guests can be catered for. The reduced sales tax for meals to 7%, which applies until 30 June 2021, will not be able to compensate for this to any extent. According to a DEHOGA survey from December 2020, 70% of hospitality businesses see their existence threatened. State aid is indispensable for these businesses. Nevertheless, the gastronomy must become more resilient and diversify its offer.

Furthermore, it is evident that eating habits and gastronomic offerings are in a state of upheaval. The trend, which was already apparent before the pandemic, is metamorphosing towards organically grown food, regionality and seasonality. Regional offerings will keep transportation distances short and support the local economy. At the beginning of 2020, the demand for organic food increased. This movement continued throughout the year and will continue in the coming year. The pandemic has strengthened the desire for healthy food and sustainability.

The hospitality industry, primarily in the high-priced sector and in metropolitan regions, is also dependent on business travellers. Quite a few companies have discovered during the crisis that virtual meetings can be just as effective and will therefore increasingly rely on this type of exchange in the future. The meeting culture will change fundamentally and sustainably. Even though the majority of companies will return to face-to-face meetings, a decline in business travel is to be expected. This development will also affect hotels in the cities. The slump in the business travel segment was massive last year. Above all, the hotels that have leased their buildings are threatened in their existence due to the high fixed costs.

Tourism

Even though the trend is emerging that more and more people are preferring holidays in Germany to holidays abroad, German tourism is in crisis. Tour operators are adapting their offerings to the extent that they are increasingly offering domestic destinations and Mediterranean regions. In 2020, every fourth TUI trip was to Hellas. Regions where the pandemic is expected to be mild are being preferred. In order to achieve an increase in bookings by package holidaymakers, TUI is now focusing on different rates of holiday packages with flights, accommodation as well as additional services in the form of flexibility. There are also signs of a stronger trend towards holiday apartments and houses as well as self-sufficient travel options. Furthermore, short breaks in the city and the great outdoors are among the favourites of German holidaymakers for 2021. These trips are mostly organized privately and without travel agencies. The camping industry in particular proved to be a winner in the crisis. While tour operators and hoteliers fear for their existence, 2020 proved to be a record year for the camping industry.

Meanwhile, the cruise industry is marked by an uncertain future. The shipping companies and shipyards are an important factor for the economy in northern Germany. Due to the loss of sales, higher prices for cruises are also being calculated. However, cruise holidaymakers will be unsettled in 2021 and remain hesitant when it comes to bookings. Not only is recurring information about cancellations and itinerary changes unsettling, but the vagueness about what restrictions can be expected during the cruise discourages booking. From the point of view of German holidaymakers, cruise tourism as well as individual and package tours will continue to expand from near regions such as the North Sea and Baltic Sea to the Mediterranean in the medium term and to increasingly intercontinental destinations in the long term.

Another factor is that many holidaymakers consider a vaccine against Covid-19 necessary before booking a trip abroad. Therefore, intercontinental travel will probably not be possible on a larger scale until the end of 2021, when many people have been vaccinated and quarantine obligations have been lifted. However, these trips require a lot of planning due to flights to and from the country. Therefore, it is likely that 2021 will be a transition year for the travel industry. Mass tourism will not take place abroad, but locally in recreational areas. Holidays in Germany will become a fully-fledged substitute for annual holidays lasting several weeks. Tour operators must therefore act flexibly in relation to the current situation. Offers that can be rebooked and cancelled free of charge, last-minute bookings and a comprehensive digitalised security concept will be indispensable.s Sicherheitskonzept werden unabdingbar sein.

Mobility

Along with the severely curtailed tourism and the absence of business travel, there were significant slumps in the aviation industry. These could not even be compensated by the increasing cargo sector, as cargo capacities in passenger aircraft were also eliminated on a large scale.

Aviation is in the midst of a profound crisis and, according to IATA, will probably not be able to recover to pre-crisis levels until 2024 - although a much faster recovery is expected for short- and medium-haul routes than for long-haul. Long-haul routes across the Atlantic and to Asia, which are heavily frequented by business travellers, will not return to their former load factors so quickly, as travel behaviour will change permanently, especially in the business customer segment. As demand for long-haul routes will only pick up again hesitantly, the carriers from the Middle East in particular will suffer, as they essentially maintain a long-haul fleet and only serve this.

As a result of the slump in passenger numbers, airports are currently suffering massively. Medium-sized and smaller airports in particular are experiencing major problems and are facing insolvency.

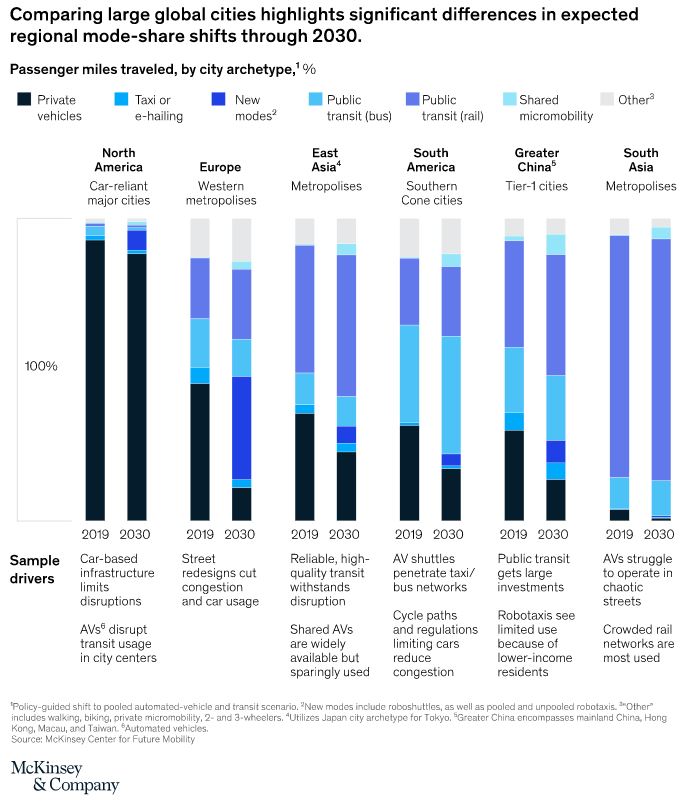

The Corona crisis has generally changed the mobility behaviour of society. The fear of infection and the focus on health are important factors in the mobility sector when choosing a means of transport. In major cities worldwide, the number of people using public transport has fallen by 70-90%. Hygienically safe modes of transport such as private vehicles or ride-sharing have gained significant popularity. However, due to increased remote working and lack of travel (both business and personal), there has also been a decline in take-up. Only bike-sharing providers saw an increase in revenue in 2020 compared to the previous year. According to a survey by McKinsey, respondents plan to continue to increase their use of bicycles or walking after the crisis. Demand for public transit will rise again, though not to pre-crisis levels for now. Shared micromobility, e-hailing and car sharing will also regain popularity. However, the mobility sector cannot assume that everything will return to pre-crisis levels, but will have to consider what the new normal will be in addition to the trends that already exist in the sector anyway.

These already existing trends are known as CASE or also ACES: Autonomous Driving, Connectivity, Electrification and Shared Mobility. Vehicles are exchanging more and more data. At the moment, entertainment and practical offerings such as digital radio or navigation systems still predominate. But maintenance and safety functions are also becoming increasingly relevant. The future of the industry also includes the planned “mobility data room”. This data is not only an important prerequisite for autonomous driving, but should also enable modern mobility services that better connect buses, trains and cars. Shared mobility includes car-sharing, ride-sharing, ride-hailing, micromobility and micro-transit. Consumers are looking for a convenient approach to mobility to get from point A to point B. In this context, owning a private vehicle is increasingly seen as a burden, as convenience and flexibility play an ever greater role. Direct access to various mobility services with simple payment systems offers a good opportunity here. It also eliminates the need for consumers to make high initial capital outlays and deal with insurance, maintenance and repairs. However, this trend applies predominantly in urban areas. In rural areas, the private vehicle remains the most popular means of transport due to a lack of suitable alternatives for economic reasons. Probably the biggest trend, and also the one most promoted by politicians, is electrification, which is seen as the future of mobility. In order to achieve the set climate targets, the emission of greenhouse gases is being pushed to a minimum. The focus is on alternative, emission-neutral or low-emission drives.

Automotive

The automotive industry is increasingly being forced to change by politicians due to new emissions regulations. From 2021, a new target value for new car fleets of 95g CO2per kilometre will apply, which effectively corresponds to an average consumption of 4.1 litres of petrol or 3.6 litres of diesel per 100 kilometres. In order to achieve the CO 2fleet and sector targets in the long term as well, a significant proportion of the new car fleet will have to be electrified. As a result, there will be substantial subsidies (environmental bonus, innovation premiums, tax exemptions, etc.) not only from politicians but also from the manufacturers themselves for electric or partially electric models. The subsidies and the agreed expansion of the charging infrastructure are bearing fruit: car sales fell by around 20% year-on-year in 2020, but car sales for electric and hybrid vehicles boomed.rzeuge boomte.

Delivery times for these models are significantly longer than for comparable models with combustion engines for all manufacturers. A return to pre-crisis levels is not expected until 2025 and even then demand for combustion engines is likely to be significantly lower due to the increased share of electric vehicles. Car manufacturers will therefore have to shift their capacity from the traditional internal combustion car market to the e-car market. This is also reinforced by the fact that in the future, the sale of new cars with combustion engines will be prohibited in some countries. VW plans to stop developing combustion engines in 2026, and Mercedes and BMW are positioning their business to also focus on electric drive in the second half of the decade.

As the digitization of vehicles progresses, manufacturers are expanding their value creation opportunities. For example, some vehicles are delivered with full equipment and the user can add equipment functions such as heated seats, cornering lights, autonomous driving, etc. in the subscription system. This will also have a lasting effect on the used car market, as the supply will increase significantly.

The structural change is also making itself felt in the supplier industry. Electric drives require entirely new components that are far fewer and less cost-intensive. In particular, suppliers who specialize in engine blocks or components for combustion engines will have to adapt their business model in good time. In earlier years, the decisive component of a vehicle was the hardware. In the future, this will become increasingly trivial and value creation will be massively dependent on software. With subscription models for additional equipment or even completely new offers such as video streaming and shopping, when the vehicles drive autonomously, completely new value creation opportunities will open up. Apple has demonstrated how selling apps can continue to make a lot of money from the software even after the hardware is actually sold. Here, car manufacturers must be careful not to be left behind by tech companies and degraded to mere suppliers. The mobility of the future is characterized by networking, safety and comfort. Hardware will remain important, but software will be the decisive factor in competition.

In addition to the structural change in the automotive industry, car dealerships also have to contend with the increasing digitalization of trade. Online trade and subscription models are also playing an increasingly relevant role in car purchases, which is why the stationary car trade will continue to lose importance. Manufacturers are increasingly taking over the new car fleet business themselves and the used car trade is also increasingly taking place on online platforms. The pace of change in the car trade varies from region to region. In urban areas, dealers will increasingly form alliances and try to establish themselves under their own brand both online and offline as a manufacturer-independent supplier of various brands.

Customers can then compare products and prices in so-called megastores. The appearance as agents of manufacturers, who take over tasks such as test drives or vehicle handovers as part of direct sales, will also be more common in the future. It is important to focus on selective points of interaction with customers to increase customer satisfaction and improve the customer experience. In rural areas, the pace of change will be much slower. This is due to the low mobility density and lower real estate and rental prices of car dealerships. Here, too, there will be a shift towards multi-brand dealerships, yet the dealer network will thin out due to a lack of appeal. As more and more people -especially in urban areas – do without their own car due to a wide range of mobility options, car dealerships should evolve from new and used car sales to mobility sales. Many dealers will take up new business models such as their own car-sharing offers or subscription models. Increasing concentration is taking place and it is expected that up to 50% of dealers will have disappeared from the market by 2025.

Energy

In order to anchor a new long-term goal of greenhouse gas neutrality in Germany before the year 2050, the amendment to the Renewable Energy Sources Act (EEG) came into force on 01 January 2021. The share of renewable energies is planned to be 65% by 2030. From this causality, transmission system operators expect an expansion of renewable energies by 5 GW and thus an increase in electricity products. In addition, European emissions trading will enter its fourth phase. In order to be able to implement the energy turnaround, grid expansion must continue. For years, there has been resistance to the construction of the necessary power lines. Another issue that will preoccupy the energy industry in the coming year is the completion of the German-Russian North Stream 2 gas pipeline through the Baltic Sea. The US government is in an effort to prevent the completion of the gas pipeline.

Pharmaceuticals and chemicals

The search for suitable vaccines against the SARS-CoV-2 virus and their distribution will continue to be the focus in 2021. Since 21 December 2020, the vaccine from Biontech and Pfizer, and since 06 January 2021, the vaccine from Moderna, have been officially licensed in the EU. Some companies have already announced that they will expand their production capacities for a Corona vaccine in order to enable the most rapid and widespread supply possible. However, not only companies involved in the production of the vaccine will benefit from the pandemic, but all those offering Corona-related products such as rapid tests or disinfectants will continue to see rising sales.

Megatrends digitalization and sustainability

It is clear that digitalisation and sustainability continue to be megatrends in all areas. The crisis has only highlighted the processes and importance of these topics even more. On average, digitised companies have come through the crisis better and have been able to adapt more quickly to the new circumstances. The standstill or severe shutdown of some production and traffic has made it clear how quickly air quality has recovered due to lower emissions of pollutants.

The topic of sustainability has become increasingly important in recent years under the banner of neo-ecology. Especially the younger society attaches more importance to sustainable and resource-efficient products for a careful treatment of the environment and the containment of climate change. For example, due to the increasing pollution of the world’s oceans and landscapes by non-biodegradable materials, there will be an EU-wide ban on certain single-use plastic products from 3 July 2021. These include cotton buds, cutlery, plates, straws, stirrers, drinks cups and food containers made from polystyrene. It also strongly promotes the reduction of greenhouse gas emissions and thus the achievement of the global sustainability goals of the Paris Climate Agreement by 2030.

Digitization has become even more important in the context of the Corona Crisis. The defining theme for 2021, resilience, is found in accelerated change in many processes such as. Cloud computing enables location-independent working and is in greater demand than before. The use of artificial intelligence and the advancing automation of manufacturing work, especially in Industry 4.0, are expected to make processes more efficient, less error-prone and less expensive. Quite a few professions will no longer be needed in the course of digitalization. According to calculations by the OECD, just under 20% of jobs in Germany were already at risk from increasing automation 2019.

Crisis winners/losers

Digitization is just one of the reasons why the technology industry is emerging as a clear winner from the Corona crisis. Companies will continue to upgrade their IT in the future to enable location-independent working and to be able to react better to such situations. In addition, the demand for augmented and virtual reality, e-games, e-sports as well as e-commerce is booming. This means that technology companies such as Amazon, Google, Apple, Facebook and Microsoft can count themselves among the biggest winners.

The pharmaceutical sector can also be counted among the winners of the crisis. It has already shown a high level of resilience to economic challenges in previous crises, partly due to the fact that it can diversify well across its subsectors.

The clear losers, on the other hand, are all industries that were affected by the lockdowns and public restrictions. These include bricks-and-mortar retail, tourism, the hospitality industry, trade fairs and event organisers. Temporary closures or restricted operations due to prescribed hygiene measures have led to significant sales losses.

Long-term challenges

Langfristig betrachtet wird sich Deutschland weiterhin mit einem sinkenden Produktivitätswachstum auseinandersetzen mIn the long term, Germany will continue to face declining productivity growth. Factors such as increasing digitalisation, demographic change and climatic structural changes will prompt new business models and production processes that will lead to profound changes in the structure of the economy and the labour market. The German economy must accept these challenges and turn them into opportunities.