YES! A year of new beginnings awaits us. Even though Covid will initially remain the dominant topic in 2022: it will fade into the background and other tasks and problems will come into focus. We will have to get used to new realities. On the one hand, uncertainties remain, but on the other hand, technological breakthroughs and the awareness of the issue of sustainability in a broad stratum of society offer the opportunity for new innovations, entrepreneurial ideas and new growth.

Before we give an assessment of the economic environment and an insight into individual sectors, a few theses for the year 2022:

- We will have to live with the virus.

- Just as there was no major wave of crisis, there will be no large-scale recovery.

- The topic of sustainability has arrived in the financial markets and will accelerate the change once again.

- Managers must face up to the permanent process of change in companies, inspire the team and see it as an opportunity.

- It’s time to get down to business and put our money where our mouth is. The megatrends of digitalisation and sustainability require active participation.

Economy global

The signs are pointing to a cautious recovery: 2022 holds a growth potential of 4.9 percent for the global economy – but not for all sectors and countries. The gap between rich and poor is also widening. Access to Corona vaccines and government support are the main factors. While financially strong industrialised nations have provided for themselves accordingly, the prospects for developing and emerging countries still look bleak. But even for the supposedly strong industrial nations, uncertainty is returning with the highest inflation rate in decades. In the USA, for example, the inflation rate climbed to 6.8 per cent at the end of 2021, the highest since 1982. In Germany, consumers had to live with 5.2 per cent. According to the ifo Institute, 2022 holds no relief in store for the Federal Republic: the inflation rate is even expected to rise to 3.3 per cent (2021: 3.1 per cent).

Asia turns out to be the ‘problem child’: as one of the most important markets, it is crucial for global growth. The International Monetary Fund expects a much slower recovery from the pandemic. The Asia-Pacific region is expected to grow by only 6.5 per cent in 2021, and by as little as 5.7 per cent in 2022.

In 2022, the current trouble spots will still be the same. According to the Emergency Watchlist 2022, a total of 274 million people will be dependent on humanitarian aid. Afghanistan, Ethiopia and Yemen in particular are affected by widespread poverty. The situation of refugees on the border with Belarus, Poland’s violations of the EU’s rule of law principles and Russia’s claim to Ukraine’s Crimea offer political and possibly military conflict potential.

Economy national

The textile trade, gastronomy, fitness studios and the leisure and event sector are suffering most from the restrictions caused by the Corona pandemic. And even the industry is currently suffering from rapidly rising costs and a continuing shortage of materials, so that demand cannot be met. The disrupted supply chains have thrown the finely tuned clockwork of ‘just in time’ production out of sync and called it into question. Another factor is the increasing shortage of skilled workers. Vacancies can rarely be filled without problems. The biggest bottlenecks are in the STEM professions. But the situation is also coming to a head in the logistics sector. In addition, the lockdowns have also presented the hospitality industry with challenges in filling the necessary vacancies, which have still not been resolved.

The economic forecast of the Munich ifo Institute assumes a plus of 3.7 percent for 2022 – the actually expected strong recovery of the German economy will thus not take place. In the meantime, other institutes are only predicting growth of 3.4 per cent. The persistent supply bottlenecks and the fourth wave of Corona, as well as the impending fifth and sixth waves, have noticeably slowed down the German economy. Price pressure is increasing. The temporary reduction in VAT was clearly visible in the development of consumer prices. But the dampening effect on the inflation rate fell short of what was theoretically possible. The economy is nevertheless expected to grow more strongly in 2023 than predicted in autumn, increasing by 2.3 per cent.

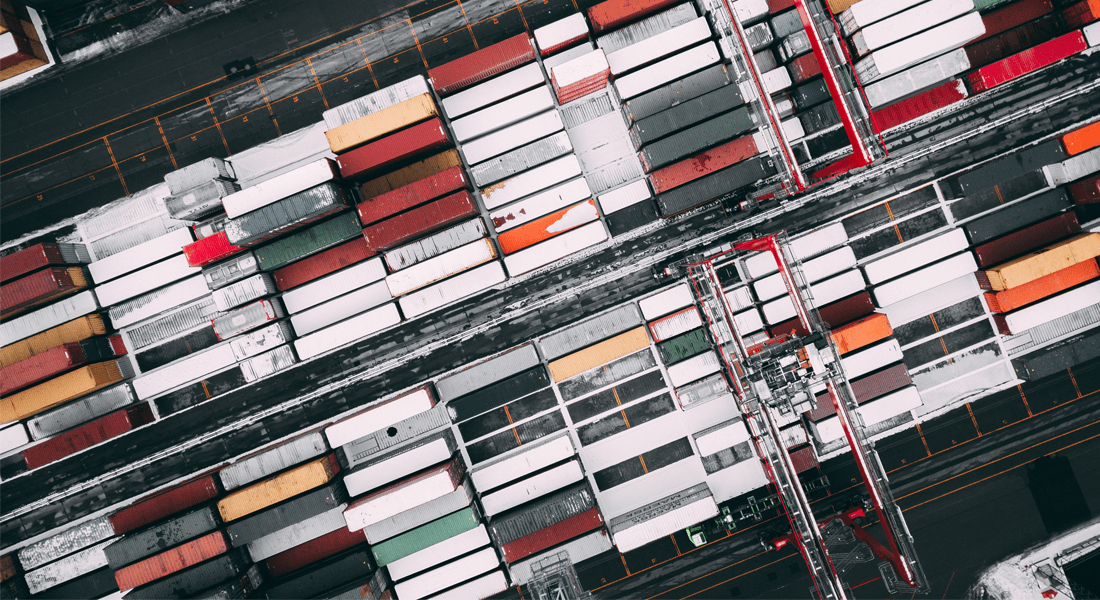

Trade and logistics

The impact of Covid-19 on trade was quickly felt and dramatic in 2020. Global trade recovered just as quickly in 2021. Despite export restrictions and supply chain issues, new record highs were reached. The largest increases were in medical goods and personal protective equipment. Worldwide, online trade has increased in recent years: The marketplaces of Amazon, Alibaba and Jumia in particular were the salvation for small and medium-sized enterprises in the lockdown to continue reaching their customers.

German trade is facing major problems: Supply bottlenecks will remain a dominant issue in 2022. The ifo Institute expects restrictions well into the summer. Among other things, the Chinese government’s zero-Covid strategy is responsible. This means that closed ports will have a lasting impact on supply chains. Currently, both freight rates and delivery times for containers are unpredictable for customers. For a year now, global transport has been in a state of emergency. Shipments are more expensive, overbooked and delayed. It is not so easy to switch to air freight, as there is also less freight capacity on the market due to the lower capacity of passenger aircraft.

Not only in sea and air freight are availabilities limited for the time being. There is a shortage of truck drivers throughout Europe and the lack of freight space has already led to a doubling of prices on some routes. In the UK, the shortage of truck drivers has already been visible in the form of empty supermarket shelves. Germany currently has a shortage of about 80,000 professional drivers. The trend is rising, as the average age is over 50, about 30,000 are retiring and only 17,000 are coming back. Unattractive working hours, little recognition and an average salary do nothing to change this. One way out could be digitization and remote control of trucks, so that in a few years it will be possible to drive remotely using cameras and sensors.

The shortage of capacities on the air, sea and land routes as well as the discussion about sustainability will result in a permanent increase in the cost of logistics. A return to normality seems unlikely. The current problems will lead to a rethinking of supply chains. The times when logistics cost nothing are over. The increasing importance of sustainability will also force companies to rethink. The flow of goods will change permanently. In the short term, warehouses will be built up and in the medium term – at least partially – production will be regionalised.

Retail

Stationary trade is facing major upheavals. The Corona pandemic has extremely favoured the development towards online shopping. Thus, e-commerce could achieve 83.3 billion Euros in gross sales in 2020 . A significant increase of 12.5 percent is expected for 2021. Online retail sales grew by an average of 16.6 percent annually between 2010 and 2019. By comparison, the entire retail sector (incl. bricks-and-mortar retail) grew by only 2.7 percent per year. Medium-sized specialist retailers are particularly affected. According to the HDE, their market share has more than halved since the turn of the millennium from around 32 percent to 15.5 percent in 2019. The changes in retail will permanently change the image of city centres and lead to a rethink.

The direct-to-consumer model is becoming increasingly attractive for companies. These manufacturers focus on selling their products directly to the end customers. Middlemen are no longer necessary. Purchasing via social media or messenger has been normalised by the pandemic and offers the right framework conditions for this.

Construction industry and real estate

The construction industry continues to be well utilised due to the robust real estate market. However, the ongoing bottlenecks in materials procurement are currently the biggest drag. Order backlogs are at their highest level in 25 years.

The real estate market continues to show its robust side and the rising demand continues to drive up prices. Due to the low-interest phase, an end to the price boom is still not in sight: According to the WohnBarometer, prices in 2022 will rise by 11.3 percent for condominiums, 9.1 percent for new flats and 7.7 percent for single-family homes.

The commercial real estate market is less euphoric, but still stable. Remote work has only led to a moderate rise in vacancies for the time being – the modern office as a shared communication centre remains popular. Especially in top locations such as Berlin, Hamburg and Munich, no oversupply is expected in the coming years. Nevertheless, requirements will change. Interest in innovative utilisation concepts is increasing significantly to make agile working methods and teams possible.

Automotive industry

The automotive industry has adjusted to the bottleneck in semiconductors and chips and is increasingly able to handle it. A slow recovery is therefore assumed for 2022. As long as the supply chains are not re-clocked and the ‘chip crisis’ is not resolved, the market will not be able to meet customer demand. ‘Just in time’ is a thing of the past and supply chain realignment is now a thing of the present. The Corona pandemic and the supply bottlenecks in semiconductors are only one challenge in the automotive sector. The entire industry is in the midst of an unprecedented technological upheaval.

Electric mobility is gaining more and more acceptance among end customers. The transformation from the combustion engine to the electric car is accelerating: experts predict that the share of electric cars in all new registrations will be 32 percent as early as 2022. And the trend is rising.

This is a development that is also being pursued by politicians. The current German government expects at least 15 million fully electric cars by 2030; plug-in hybrids will no longer be included. An ambitious goal when there are currently not even one million electric vehicles – including hybrid models.

In addition, suppliers are having problems at the moment to remain able to deliver to the OEMs because the prices for raw materials have risen massively and the additional costs can only be passed on to a limited extent. In addition, the next few years will decide who can best adapt in the area of hardware and software and play in the league of the big tech companies. In the future, the heart of a car will be the software and not, as in the past, the engine. In addition, software opens up new sales channels to the customer. Be it through temporary sales by activating special equipment or the possibility of using third-party providers such as shopping or streaming services.

Mobility

The 2021/2022 winter flight schedule gives the industry hope: 68 per cent of flight capacity has been restored at German airports compared to pre-crisis levels. A further normalisation is expected in 2022. The USA and Canada can also be flown to again; connections to Asian countries such as China, Japan and Thailand are far from prominent again due to travel restrictions. Domestic European destinations are 72 per cent available. However, domestic German air traffic records significantly lower figures with a resumption rate of 50 per cent. The main reason is the loss of business travel – and the numbers will not recover in the future. Thus, a consistent minus of 25 to 30 per cent is forecast.

The reasons are clear: increased digitization, cost savings and the sustainability megatrend. The industry must change. Cheap flights for ten Euros or less will no longer exist in the future. Developments such as CO2-free jet fuel are available, but are not (yet) being used on a large scale. In addition, increased sick leave is currently halting the slight upswing in global air traffic. In recent weeks, thousands of flights have been cancelled due to staff shortages. There is currently no short-term improvement in sight and further cancellations are expected in the next few weeks as part of the current ‘Omikron’ wave.

What the crisis has sustainably managed to do is to ignite the triumphal march of the bicycle as a model for the future: ‚Xycles’ are defined as cargo bikes, commuter vehicles, courier vehicles or last-mile concepts. The private car is being pushed further and further out of the cities. Instead, the use of diverse mobility options is being integrated into everyday life. Direct access to various vehicles with simple payment systems makes it possible: quickly ride a city bike through narrow streets to the next train station. This not only saves time, but also money: insurance premiums as well as maintenance and repair costs are eliminated.

‘Connecting the Countryside’ will turn rural regions into urban, well-connected spaces. This will be made possible by increased car sharing and pooling services, which are now also arriving and will not only be available in cities.

Energy

The commissioning of Nord Stream 2 in 2022 remains an unknown. “European energy law applies to energy policy projects in Germany as well.” This sentence from the coalition agreement of the SPD, Bündnis 90/Die Grünen and FDP could mean the end for the Nord Stream 2 gas pipeline. European law is clear – the operator of a pipeline and the gas producer must be separate. However, Nord Stream 2 is a subsidiary of the Russian company Gazprom.

At the end of the year, the last German nuclear power plants will be shut down. It is important to prepare for this energy policy stress test. How can a blackout beprevented and how do we deal with dependency in the future while keeping prices within socially acceptable limits? A reorientation of national electricity generation will become increasingly important in the coming years. Although the share of nuclear energy was recently only around 11 percent, the phase-out of coal is also to take place in this decade. And in order to be climate-neutral by 2050 at the latest, the lifetimes of gas-fired power plants are also already limited. In addition to the electricity lines that are not yet needed, the question of production itself has not yet been conclusively answered.

A major challenge remain the rapidly rising energy prices, which must not develop into a location risk. However, it is certain that Germany will develop from a former energy exporter to an energy importer and that the change will not be possible without French nuclear power and Eastern European coal-fired power.

Pharma and chemistry

Corona vaccines as a ‘booster’ for the entire pharmaceutical industry? While the sales revenues of the German companies involved in the vaccine were on average about one fifth higher in the 1st half of 2021 than the corresponding figure for the previous year, other companies generally had to live with declining sales. Demand in the chemical industry also weakened. This is due to the problems in the global supply chains.

Research and development are elementary for chemical and pharmaceutical companies – this is reflected in the expenditure. German pharmaceutical companies invested around 13.7 billion Euros (+2.5 %) in 2020. The goal: vaccines and medicines for the treatment of covid 19 patients. In 2022, the focus will shift back towards oncology. Research into active agents against cancer and immune diseases is being carried out at full speed. Drugs made from messenger ribonucleic acids (mRNA) will play a key role here. With mRNA, cells can be modified to produce any kind of protein. With the combination of digital and biological tools, completely new applications for drugs are possible.

Trade fairs and events

The event industry is one of the biggest losers of the pandemic. With about 60 per cent of the world’s leading events, Germany is an important location – but almost no congresses and trade fairs took place between March 2020 and June 2021. Digital alternatives were less successful. The loss of turnover is estimated at 70 per cent. A loss that is also clearly felt in the overall economy: according to the Association of the German Trade Fair Industry, this amounts to 43.5 billion Euros, because the hotel industry, gastronomy, transport industry, trade and crafts also profit directly from trade fairs and events.

Despite digital events and congresses, the concept of on-site trade fairs will continue to be the first choice. However, digital offerings will be added here so that events can also be streamed independently of time zones and reach can be increased.

An insurance programme developed by the federal and state governments is intended to make the organisation and planning of major events even more attractive. Event-related costs of up to 600 million Euros can be covered. For the time being, this applies to events until 30 September 2022; an extension of the period is expected.

Tourism

There will be no ‘return to pre-crisis levels’ in 2022 – the industry agrees on that. In 2023 at the earliest, it will be possible to come close to the revenues of recent years. However, the traffic light coalition is currently considering an increase in the air traffic tax, which will come into force after 2023 and lead to a further increase in the price of medium- and long-haul tourism.

But the signs for a strong tourism summer in 2022 are already visible – Germans want to travel again. Postponed or cancelled trips are being made up for. Particularly popular: Mediterranean destinations such as Spain, Greece and Turkey as well as places in Germany or neighbouring countries that can be reached by train, bus or car. It is becoming apparent that customers are booking at increasingly short notice. A behaviour that shows the lasting uncertainty triggered by the pandemic. This is also made clear by the boom in holiday flats and houses. They are options that make more isolated holidays possible than in a hotel and thus offer greater security from potential contagions.

Hospitality industry

The recent positive outlook for the winter season 2021/2022 will not become reality due to the 4th wave of the pandemic. 2G and partly 2G Plus are already established and provide for additional expenditure with fewer customers at the same time. A complete lockdown with renewed closures should be avoided at all costs. Another problem: lack of skilled personnel. In Germany alone, about 325,000 skilled workers turned to other industries during the pandemic – the prospects for a quick recovery of the catering sector were too uncertain. With the increase of the minimum wage to12 Euros planned by the current German government, businesses expect an additional increase in personnel costs of 15 to 25 percent, according to the results of a DEHOGA survey .

The common denominator of gastronomy and the hotel industry is business travellers. Here, significant losses were recorded during the last two years. A development that will only recover marginally. Joint meetings no longer have to take place in rented conference halls or at the closing dinner. Digital video conferences are more efficient and less expensive. Therefore, although such meetings are less frequent, they are also much more celebrated and appreciated. This is an opportunity for restaurant and hotel operators to position themselves accordingly with special events/packages.

No seating, no service staff, just kitchens and suppliers: The number of ghost kitchens will continue to rise in 2022. Online-only delivery services are attractive options for restaurateurs, precisely because fewer costs are incurred and higher turnover is possible. The trend towards increased online ordering favours this model.

Regional rice? ‚Local exotics’ are another trend for 2022, with fruit and vegetables now being planted that actually come from other parts of the world. In Austria, for example, people are already growing rice, wasabi, figs or ginger. In this way, the longing for exoticism that prevailed in the Corona pandemic is combined with the goal of buying more regionally. After all, sustainability and the shortest possible delivery routes are increasingly important factors for many consumers when making purchasing decisions.

Healthcare

The pandemic brought many hospitals to the edge of their capacity at times: the resulting economic losses were lower than in other sectors due to high compensation payments. For example, hospitals were supported by the federal government with a total of 10.2 billion Euros, e.g. for protective clothing, beds kept free and intensive care unit supplements. Nevertheless, according to the Hospital Rating Report, 20 percent of the hospitals have not received adequate financial compensation. In 2022, the economic problems that were already there before Corona will return: Fewer patients, more expensive treatments and inefficient management. In particular, the trend towards more outpatient examinations and treatments will result in lower revenues. If the number of patients remains low, three quarters of the hospitals are threatened with losses from 2022 and an average minus of ten percent in the annual result by 2030. To counteract this, the structures in the sector must be optimised: Adjustment of capacities, i.e. reduction of beds and closure of hospitals. Treatment centres with outpatient and inpatient services will take up more and more space for patients in the future and displace classic clinics.

With the planned legalisation of cannabis for consumption purposes, the trend to use CBD and THC for medicinal purposes will also be further strengthened. This will enable new medicines and services in the primary health care market. Resonant spaces are also becoming increasingly important: new work and individualisation are creating healthy environments, merging life and work (work-life blending). They show that in addition to physical health, mental balance is becoming increasingly important.

Megatrends digitization and sustainability

In 2022, digitization and sustainability will continue to set the tone for megatrends. The pandemic has revealed where there is a need to catch up. On average, digitised companies came through the crisis better and were able to adapt more quickly to the new circumstances.

Digitization has continued to gain in importance. New technologies now influence all areas of social and economic life. They change the way we inform ourselves and how we communicate. As development continues, data protection is also becoming increasingly important: companies have large amounts of data, but some of it is not sufficiently protected. Hacker attacks will increase in the future, which is why professional risk management must be further prioritised.

A new multi-billion market is crystallising with augmented reality (AR) and virtual reality (VR). Both Apple and Meta as well as Google and Microsoft are working on corresponding glasses with which users can immerse themselves even more deeply in the digital worlds. The breakthrough is currently still prevented by the excessive weight, limited performance and data protection concerns. But the potential to replace the smartphone is still there and Apple will play a key role here.

The topic of sustainability has become increasingly important in recent years in the context of neo-ecology. Thetemporary Covid crisis has not changed this. The younger population in particular attaches more importance to sustainable and resource-efficient products for a careful treatment of the environment and the containment of climate change. Even without political intervention, a transformation of the economy will take place in the next few years: Away from growth and profit maximisation towards an intelligent and sustainable use of resources. This is not a purely ethical movement, but also makes economic sense in view of the lack of resources. The standstill or severe shutdown of some production and transport has shown how quickly air quality has recovered due to lower emissions of pollutants. However, this was only a temporary effect and a fundamental rethink is needed. The future of our coexistence must be shaped ecologically.

(Sources for the article can be found in the PDF document)