Overcoming the challenges of the Corona crisis

The Corona crisis is a global challenge. Many companies have run into financial and operational difficulties as a result. WAYES supports clients through active crisis management – quickly and consistently.

FAQ

- What state aid can companies take advantage of?

- When can a company order short-time work?

- What exactly has been simplified in the case of short-time allowance under Corona?

- What loans are available for companies that have been in crisis before?

- What exactly does the suspension of the obligation to file for insolvency mean?

- Insurance cover and Corona – what do companies have to pay attention to?

- What relief is available for obligations arising from income, revenue or sales taxes?

- How and from when must the Corona crisis be taken into account in accounting?

- In what circumstances is the director liable for payments made despite Corona-induced insolvency?

What state aid can companies take advantage of?

Simplified access to short-time allowance

Federal export credit guarantees

Fiscal liquidity assistance:

- Easier deferral of tax payments

- Reduction of advance tax payments

- Waiver of enforcement and late payment penalties

Public liquidity support:

- Loan programmes of KfW and the state development banks

- Extended guarantee programmes

- Liquidity grants from the federal and state governments

When can a company order short-time work?

Prerequisites are:

- Significant loss of work due to the consequences of the Corona crisis

- No outstanding residual leave or time credits

- Return to full employment is likely

What exactly has been simplified in the case of short-time allowance under Corona?

- 10 % of the workforce is affected by absenteeism (instead of the previous 33 %)

- Social security contributions for short-time workers are paid in full by the employment agency.

- Short-time work is also possible for temporary workers.

- Companies with working time fluctuations are not obliged to build up negative working time accounts.

- All changes are retroactive to 01.03.2020 – we are happy to support you with the application.

What loans are available for companies that have been in crisis before?

Companies that were already in crisis before Corona (e.g. due to restructuring or losses) can also take advantage of KfW’s assistance programmes and guarantees. The prerequisite is that the company was ”not in difficulty” on the cut-off date of 31.12.2019. According to the EU definition, none of the following criteria may apply:

1. In the case of a limited liability company: more than half of the subscribed share capital (including any share premium) has been lost as a result of accumulated losses. This is the case if, after deduction of the accumulated losses from the reserves (and all other elements generally included in the company’s own funds), there is a negative cumulative amount corresponding to more than half of the subscribed share capital.

2. In the case of companies where at least some shareholders have unlimited liability for the company’s debts (e.g. KG, OHG): more than half of the own funds shown in the accounts have been lost as a result of accumulated losses.

3. The company is subject to insolvency proceedings or fulfils the conditions under national law for the opening of insolvency proceedings at the request of its creditors.

4. In the case of a company that is not an SME*: For the past two years, the book value-based leverage ratio has been above 7.5 and the ratio of EBITDA to interest expense has been below 1.0.

SME: up to 249 employees and either up to €50 million in sales or up to €43 million in total assets (if part of a group, key figures of the group must be added).

In addition, KfW requires ”orderly economic circumstances” for its promotional programmes. This means in particular:

1. No unpaid arrears older than 30 days

2. No deferral agreements or covenant breaches The individual case must be examined on the basis of these criteria.

The individual case must be examined in the light of these criteria.

What exactly does the suspension of the obligation to file for insolvency mean?

Based on the COVID-19 Insolvency Suspension Act (COVInsAG) passed by the legislature, the suspension of the three-week insolvency filing requirement has been suspended until December 31, 2020 for companies that are over-indebted but not insolvent. The condition is that the filing requirement is based on the impact of the Covid 19 pandemic and the reason for filing did not exist as at 31 December 2019. This means that from 01 January 2021, the obligation to apply will generally apply again. The only exception to this is for companies with a reasonable prospect of receiving government assistance. The Federal Government is thus reacting to the delay in the payment of the November and December aid as well as the bridging aid III.

Thus, until April 31, 2021, a suspension of the obligation to file for insolvency applies to insolvent or over-indebted companies if the insolvency maturity is based on the Covid 19 pandemic and an application for financial assistance under government assistance programs has been filed by February 28, 2021. If, for legal or factual reasons, it is not possible to file an application within the time period, the basis for the application shall be eligibility.

Insurance cover and Corona – what do companies have to pay attention to?

Business interruption insurance: Infectious diseases and pandemics are generally not included in the insured risks, so no insurance cover!

Practice closure insurance and business closure insurance: Infectious diseases can be insured here, but there is usually an exclusion for pandemics, so there is usually no insurance cover!

Company pension scheme / company pension: In the case of short-time work, contributions could be suspended for a limited period (12 months) with the employee’s consent.

Reduce insurance costs in the short term without losing insurance cover: For example, if the sales forecast for 2020 is significantly lower than the sales for 2019, it is possible to negotiate with the business liability company to immediately lower the sales and thus the insurance premium. There are even cases where insurance companies have refunded premiums.

What relief is available for obligations arising from income, revenue or sales taxes?

The Federal Ministry of Finance (BMF) has also promised tax liquidity assistance for companies in a comprehensive package of measures. These include the following measures, among others:

Interest-free deferral of income tax, corporate income tax and value-added tax for taxpayers who are demonstrably directly and not insignificantly affected until 31 December 2020, subject to a presentation of their circumstances. The damages incurred do not necessarily have to be proven in detail in terms of value. Applications for deferral of taxes due after 31 December 2020 must be specifically substantiated.

Companies must apply for deferral of trade tax to the responsible municipalities (exception: city states). However, these are not subject to the instructions of the state tax authorities.

Requests for adjustment of advance payments relating only to periods after 31 December 2020 shall be specifically justified.

Deferral of income tax is not possible.

Reduction of advance payments for income tax and corporate income tax and of the trade tax assessment amount for the purposes of advance trade tax payments for taxpayers who are demonstrably directly and not insignificantly affected until 31 December 2020, setting out their circumstances. The damages incurred do not necessarily have to be proven in detail in terms of value.

Suspension of enforcement measures such as account seizures until 31 December 2020, as long as the tax debtor is directly and not insignificantly affected by the effects of the Corona virus.

How and from when must the Corona crisis be taken into account in accounting?

In the opinion of the IDW, it is to be assumed that the occurrence of the Corona virus is to be classified as giving rise to value, since the sudden spread of the virus did not occur until 2020. This means that the accounting consequences of the Corona pandemic are generally only to be taken into account in both HGB and IFRS accounting in financial statements with a reporting date after 31 December 2019. However, if there are risks that could jeopardize the company’s continued existence, these must be discussed in the notes and, if necessary, in the management report. In addition, ”events of particular significance” must be reported as part of the supplementary reporting. Furthermore, the principle of consistent recognition and measurement may be deviated from under certain circumstances if this provides a better insight into the net assets, financial position and results of operations.

In what circumstances is the director liable for payments made despite Corona-induced insolvency?

A managing director is in principle protected from liability, provided that

1. the requirements for the suspension of the obligation to file for insolvency under COVInsAG are met

AND

2. the payments serve the proper course of business, the maintenance or resumption of business operations or the implementation of a restructuring plan.

Nevertheless, this does not exempt the managing director from all criminal risks. It is true that criminal liability for delaying insolvency is excluded under the above-mentioned conditions. However, the following offences remain valid:

1. Breach of the obligation to keep accounts

2. Creditor disadvantage / debtor benefit

3. Bankruptcy

The effect of the COVInsAG on these facts must be examined in detail in each individual case. For this reason, we recommend that, in addition to the prompt preparation of a financial status under insolvency law, you obtain the assessment of a specialist lawyer for insolvency law. We will be happy to support you in these steps and involve the relevant specialist lawyers from our network.

Funding and credit options at a glance

- Economic Stabilisation Fund

- KfW – Reconstruction Loan Corporation

- Corona bridging aid III

- Corona bridging aid III Plus

- Equity grant

- Short-term liquidity

The federal government is providing emergency aid of €10 billion to all those affected by the shutdown in the period November and December. Solo self-employed workers and businesses will receive a one-off grant of 75% of their respective turnover in November or December of the same period last year. For businesses that do not report sales in 2019, the previous month will be used as the basis for the calculation. The maximum amount is currently set at €2 million.

Companies that have had to cease operations as a result of the decision of 28 October 2020 and those that can prove that they generate 80 % of their turnover from the companies affected by the closures are eligible to apply. In addition, companies that regularly generate 80 % of their turnover through supplies and services provided on behalf of companies directly affected by the measures via third parties (e.g. via agencies).

Other assistance such as Corona bridging assistance and short-time working allowance will be offset against the emergency assistance. To ensure that the money reaches those affected as quickly as possible, advance payments of 50% (maximum €50,000) are automatically granted. For both procedures, the application is submitted by a tax advisor or accountant. The application deadline for initial applications is 30 April 2021, while applications for amendments can be submitted until 31 July 2021.

Economic Stabilisation Fund

The fund has a total volume of €600 billion.

We list the main components below:

1. State guarantees for companies

The guarantees are to be legally classified like sureties, although the question of the percentage amount is still open. Guarantees of up to €400 billion are to be issued to eliminate liquidity bottlenecks and to support refinancing on the capital market. The term of the guarantees and the liabilities to be covered may not exceed 60 months.

2. Direct shareholdings by WSF

100 Mrd. € sollen für direkte Unternehmensbeteiligungen bereitgestellt werden: So wird das Finanzministerium er100 billion is to be made available for direct corporate investments: Thus, the Ministry of Finance is authorized to ”borrow up to €100 billion” for the WSF to cover expenses and measures.

3. Loans from the WSF to KfW

The WSF is making a further € 100 billion available to KfW to refinance the special programmes created by the Corona crisis. KfW is to provide liquidity support to companies in the event of bottlenecks.

KfW – Reconstruction Loan Corporation

Quote from the KfW website:

“As a company, self-employed person or freelancer, you have got into financial difficulties due to the Corona crisis and need a loan? If so, you can now apply to your bank or savings bank for a loan for investments and working capital, provided you were not in difficulty by 31 December 2019. Every application will be processed at full speed to help you as quickly as possible.”

Currently, the following programs are available:

1. Loans to enterprises that have been on the market for more than five years

KfW Entrepreneur Loan

When you apply for a loan for investments and working capital, KfW assumes part of the risk of your bank.

- For large companies, up to 80 % risk assumption

- For small and medium-sized enterprises up to 90 % risk assumption

This increases your chances of getting a loan approval.

They can apply for up to €100 million per group of companies.

The maximum loan amount is limited to

- 25 % of the annual turnover 2019 or

- twice the wage cost of 2019, or

- the current financing requirements for the next 18 months for small and medium-sized enterprises* or 12 months for large enterprises, or

- 50 % of the total debt of your company for loans exceeding € 25 million or 30 % of the balance sheet total.

Interest rates range between 1 % and 2.12 % p.a.

2. Loans to enterprises that have been on the market for less than five years

ERP Start-up Loan – Universal

If your company has been active on the market for at least three years, you can apply for a loan for investments and working capital. In doing so, KfW assumes part of the risk of your bank. This increases your chances of receiving a loan approval.

- For large companies up to 80 % risk assumption

- For small and medium-sized enterprises* up to 90 % risk assumption

You can apply for up to €100 million per group of companies. The maximum loan amount is limited to

- 25 % of the annual turnover 2019 or

- twice the wage cost of 2019, or

- the current financing requirements for the next 18 months for small and medium-sized enterprises* or 12 months for large enterprises, or

- 50 % of the total debt of your company for loans exceeding € 25 million or 30 % of the balance sheet total.

Interest rates range between 1 % and 2.12 % p.a.

If your company has been on the market for less than three years, you can still apply for a loan for investments and working capital, but without KfW assuming any risk.

The maximum loan amount is € 25 million per project.

Interest rates range from 1.03% to 7.43% p.a.

3. Direct participations for syndicated financing in the amount of € 25 million

Direct participation for syndicated financing

KfW participates in syndicated financing for investments and working capital of medium-sized and large companies. KfW assumes up to 80 % of the risk. The loan amount is limited to a maximum of 50 % of the group’s total debt or 30 % of the balance sheet total. The higher of the two limits is decisive.

KfW’s share of the risk is at least € 25 million and is limited to

- 25 % of the annual turnover 2019 or

- twice the wage cost of 2019, or

- the current financing requirements for the next 12 months.

Optionally, all banks participating in the consortium can be refinanced by KfW.

4. KfW fast loan

If your company has been on the market since at least January 2019, you can apply for a loan for investments and working capital with 100% risk assumption by KfW.

Depending on the size of the company, the maximum loan amount is limited to

- 25 % of the 2019 annual turnover per group of companies or

- 675,000 € per group of companies up to and including 10 employees

- 1.125.000 € per group of companies with more than 10 up to and including 50 employees

- 1.800.000 € per group of companies with more than 50 employees

The interest rate is 3 % p.a.

Corona bridging aid III

The Corona bridging aid for small and medium-sized enterprises is a joint offer by the Federal Government and the Länder.

It is in its third phase and covers the funding months November 2020 to June 2021. Applications for funding can only be made through (or in cooperation with) tax advisors, tax consulting lawyers, auditors or certified public accountants.

Eligible applicants are:

- Solo self-employed and self-employed members of the liberal professions in their main occupation in all sectors

- Companies with a turnover of up to € 750 million in 2020

- Companies with a turnover of more than €750 million, provided they are companies directly affected by the closures in the retail, event and culture, hotel, catering, wholesale, travel or pyrotechnics sectors The prerequisite is a drop in turnover of at least 30% in one month compared to the reference month in 2019. Companies receiving November and/or December aid are accordingly not eligible to apply for the months of November/December.

The maximum amount of funding is € 1.5 million (€ 3 million for interconnected companies) and is calculated as follows:

Reimbursement of a share of 100 % of the eligible fixed costs in the event of a drop in turnover > 70 % Reimbursement of a share of 60 % of the eligible fixed costs in the event of a drop in turnover ≥ 50 % and ≤ 70 %.

Reimbursement of a share amounting to 40 % of the eligible fixed costs in the event of a drop in turnover ≥ 30 % and ≤ 50 % An application is possible until 31 August 2021. Eligible applicants can receive payments on account amounting to 50 % of the subsidy amount applied for (but not more than € 100,000 per month).

Eligible costs include:

1. Rents and leases that are directly related to the business activity of the company (this also includes costs for home offices if they have already been deducted for tax purposes in the corresponding form in 2019)

2. Other rental costs (e.g. vehicles and machinery used for operational purposes)

3. Interest expenses on operating loans and borrowings (but not negative interest and custody charges)

4. Depreciation under commercial law for fixed assets at a rate of 50 % (unscheduled depreciation not included, unless it is due to Corona)

5. Financing cost portion of leasing instalments

6. expenditure on necessary maintenance, servicing or storage of fixed assets and rented and leased assets, including IT (provided that it is charged to expenditure and is not reimbursed; conversion and renovation work is excluded)

7. Expenditure on electricity, water, heating, cleaning and hygiene measures

8. Property taxes

10. Insurance, subscriptions and other fixed operating expenditure (not eligible are, for example, variable taxes such as business tax, costs of freelance workers or private insurance)

11. Costs for auditing third parties incurred in the context of the application for Corona Bridging Aid III

12. Personnel costs (not covered by short-time allowance; taken into account at a flat rate of 20 % of the fixed costs of the previous eleven points)

13. Costs for trainees (excluding interns)

14. Structural modernisation, renovation or conversion measures up to €20,000 per month for the implementation of hygiene concepts (if the costs were incurred in the period from March 2020 to June 2021; one-off investments in digitalisation up to €20,000)

15. Marketing and advertising costs (maximum in line with expenditure in 2019)

Corona Bridging Aid III Plus

The German government is extending the bridging aid for affected companies and self-employed individuals until 30 September 2021. The tried and tested funding conditions from the Corona Bridging Aid III will continue in the Bridging Aid III Plus. Accordingly, only companies with a Corona-related slump in sales of at least 30 % are eligible to apply in the Bridging Assistance III Plus. In addition, a so-called restart premium, with which companies receive a higher subsidy for personnel costs, will be introduced. The Restart Premium will continue as Restart Premium Plus until 30 September 2021. The new programme will also be applied for by the examining third parties via the federal government’s Corona portal.

Both programs include:

The maximum monthly subsidy in Bridging Assistance III and Bridging Assistance III Plus is €10 million.

The ceiling for funding from both programmes is €52 million. This can be divided into €12 million from the current EU framework consisting of small aid, de minimis and fixed cost aid and €40 million from the new federal damage compensation scheme. The new EU rules on damage compensation apply to companies directly or indirectly affected by state closure measures. They will be able to claim damages of up to €40 million.

New to the Bridging Assistance III Plus program:

Companies that bring back staff from short-time work, hire new staff or otherwise increase employment in the course of the reopening receive a personnel cost subsidy, the so-called restart premium, as an alternative to the existing flat-rate personnel cost allowance, as a subsidy for the resulting increase in personnel costs. In this context, companies receive a subsidy of 60% on the difference between the actual personnel costs in the subsidy month of July 2021 and the personnel costs in May 2021. In August, the subsidy is still 40% and in September 20%. As of 01.10.2021, no more subsidies will be granted.

In future, lawyers’ and court costs of up to €20,000 per month will be reimbursed for the insolvency-preventing restructuring of companies in imminent insolvency.

New start-up support for solo self-employed workers will be extended and will increase from up to €1,250 per month for the period from January to June 2021 to up to €1,500 per month for the period from July to September 2021. This means that for the entire support period from January to September 2021, solo self-employed workers can receive up to €12,000. Multi-person corporations and cooperatives will receive up to €6,000 per month for the period from July to September 2021 instead of €5,000 per month for the period from January to June 2021. Accordingly, multi-person corporations and cooperatives can receive up to €48,000 for the entire period.

Equity grant

With the new equity grants, the federal government is offering further financial aid to companies that have been hit particularly hard and for a long time by the Corona-related closures.

Eligible companies are those that have at least a 50% drop in sales for at least 3 months in the period November 2020 to June 2021.

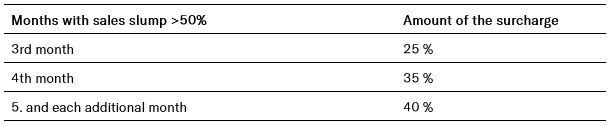

The grant will cover up to 40 % of the amount of the eligible fixed costs (fixed costs under points 12-15 above are excluded) and will be scaled as follows:

The grant is considered to be additional support and is granted in addition to the support provided under Bridging Grant III.

Short-term liquidity

Securing liquidity is the focus for many companies. The duration of the application and approval process for state financial aid is difficult to estimate. Companies are therefore forced to take suitable measures to bridge the transitional period until a possible disbursement from their own resources.

- Liquidity status

- Short-term liquidity planning with and without corona effects

- Delete non-essential costs and investments

- Short-time work and termination of short-term employment relationships

- Reduction of stock

- Negotiation of new conditions with customers and suppliers

- Implementation package to avoid the need to file for insolvency

- Deferral of repayments by arrangement